It’s a fact: Most business owners will execute a living buyout rather than have a business owner die prematurely. That singular fact makes it critical to have a buy/sell agreement in place that can provide protection from a premature death while simultaneously position the business owner for their eventual retirement.

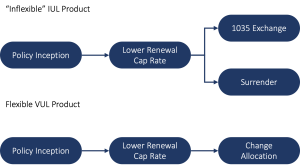

In one of our industry’s more delicious ironies, the type life insurance typically used to fund Buy/Sell Agreements (BSAs), term insurance, is probably the least appropriate funding solution. The truth of the matter is that a permanent solution, with properly structured ownership, places a powerful financial planning tool in the hands of each business owner. A permanent life insurance solution can not only fund their BSA, but also provide supplemental, tax-favored retirement income, long-term care benefits and more.

The reasons for this trend can obviously be attributed to price in some instances, but there are other factors at play. A significant one is the perceived lack of control in most cases stemming from either another owner or the business itself controlling the policy. In most instances this can be traced back to a knowledge gap relative to the types of agreements beyond those two basis structures. Fortunately, in this particular instance, the solution not only addresses the fundamental issue outlined above, but it does so without having to increase the complexity of the agreement to the point it becomes unwieldy, if not prohibitive to administer.

If step one in this process of designing a more effective BSA is simply moving from term insurance to permanent, the next step is addressing ownership. In too many cases, the simplicity and ease of implementation that comes with a stock redemption plan, with the business owing the policies, receiving any death proceeds, and “redeeming” the shares of the deceased owner is too tempting. This not only eliminates the possibility of significant tax savings for the surviving owner, a topic for another discussion, but stilll places the business owner at a disadvantage relative to controlling all of their insurance assets as the company remains the owner and beneficiary of the surviving owner’s policy. Traditional cross purchase designs, while more advantageous from a tax perspective, still present the issue of lack of control: The other owner owns the insurance! While these two approaches can accomplish the ultimate goal of providing funding for the BSA when it is needed, it is far from an optimized solution.

That leaves the obvious question: If both of these types of BSA are less than ideal, what’s the answer? While each planning scenario is different and should be evaluated on its own merit, the “Cross Endorsement” structure checks man of the boxes discussed here:

Each business owner is the owner of the policy on their own life.

As a result, they control the death benefit, cash values and any living benefits the policy may provide.

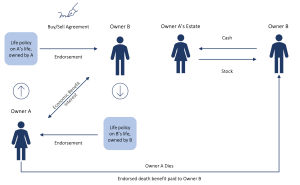

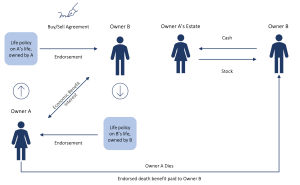

A simple assignment form the secures the portion of the death proceeds needed to buy out the other business owner at their death.

More importantly, this also allows each owner to make full use of the policy as part of their retirement, long-term care and perhaps even estate planning if they, like most business owners, execute a living buyout.

Finally, at retirement this all happens without some sort of taxable event or an esoteric exemption to the transfer for value rules most do not understand, let alone plan for effectively.

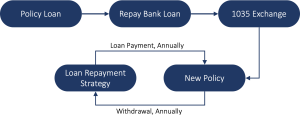

Figure 1, below, shows the basic mechanics of this approach in terms of the flow of funds if one of the owners pass away. What it doesn’t do, is address how each owner can make the “highest and best use” of their policy. To do that, it is critical to move the owner beyond viewing this premium associated with their BSA funding strategy as an expense to something that creates an asset on their personal balance sheet. That effectively eliminates term insurance from the conversation.

The key subject matter areas to discuss with the owner as they consider how to structure their funding strategy with permanent insurance include:

- Their protection needs beyond the BSA. Specifically, is their personal insurance adequate? If not, simply increase the amount of coverage on the policy to an amount that covers both the business and personal need.

- Have the planned for the potential need for care as they age? If not, consider the use of a Chronic Illness or Long-Term Care Rider on the policy.

- Is their retirement plan adequately funded? If not, consider a policy designed to accumulate cash value while also providing a death benefit. This could also solve challenges like limitations on qualified plan contributions.

The beauty here is in the flexibility. Each owner can design their own strategy based on their needs. Once in force, simply filing the assignment secures the other owner’s interest in the death benefit in an amount equal to their obligation under the BSA.

As simple as this strategy is, there are some places where Business Owners may try to cut corners. Specifically, this arrangement does not eliminate the need for a formal, written BSA. Further, the BSA needs to be reviewed regularly, including updating the value of the business. If they want to pay for the coverage through the business, as most Business Owners do, there will likely be personal income taxes due on those funds, likely treated as compensation. There may also be tax due on the economic value of the assigned coverage. Both of these issues make the Business Owner’s CPA or other tax expert a critical part of the conversation.

There are additional benefits to the Cross Endorsement or “Living Benefits” Buy Sell Agreement, including:

- Personal ownership of your policy — The Business Owner names the primary beneficiary and controls the cash value. Any death benefit not committed to the buy-sell agreement can go to family or other personal beneficiaries.

- Younger and healthier owners aren’t required to pay premiums on older and less healthy business partners as they might be with a cross purchase buy-sell agreement.

- You can fund your own policy at a higher level to build greater cash value for your future use.

- Policy is portable — if the business ends or you retire, you still retain the policy and any cash value.

- As an individually owned policy, it may be protected against business creditors depending upon the laws of your state.

The bottom line? There is far more utility from a Cross Endorsement BSA funded with permanent insurance than is available from other agreement types or agreements funded with term insurance. We would all benefit from taking a moment to consider the rest of the Business Owners planning versus pursuing the path of least resistance.