Best practices exist for a reason, as do products that may cost a bit more but offer superior value. In this real-life example, an insurance solution that is built for the business market would have streamlined a key component of buy/sell agreement management that could have prevented multiple days in tax and appeals court.

It comes as a surprise to no one that insurance assets need to be reviewed periodically. What may be a surprise is how significant a problem could result if you don’t. Case in point? 2023’s Connelly decision. The details of the case are worth understanding (Follow this link for more on the case), but there’s one element of the decision that is particularly important for anyone working with business owners: The court affirmed the IRS’s position that the proceeds of a life insurance policy that funded a buy/sell agreement were includable in the value of the business, rather than offset by the obligation of the business to redeem the deceased owner’s shares under the terms of their Buy/Sell agreement. This increase in the value of the business led to a $1MM increase in estate taxes.

While there are multiple issues involved, the most fundamental called out by the court in their decision focused on the business not following the terms of the buy/sell agreement. Specifically, the agreement called for a “Certificate of Agreed Value” that set the price of the business by mutual agreement on annual basis. Failing that, the agreement called for two or more appraisals to determine the fair market value of the business. Neither of these were done.

After the owner’s death, they parties involved agreed on a value, executed the sale, and proceeded to file the necessary estate tax return. The audit of the return uncovered the lack of compliance with the terms of the buy/sell agreement, resulting in the inclusion of the proceeds of the life insurance in the value of the business and the increased estate tax. The Connelly decision may not be the last word on this, as the Connelly family appealed, and the Supreme Court has agreed to take up the case.

In this case, the amount of life insurance, $3.5MM, was relatively close to the agreed upon value of $3.89MM the family used. This is rather surprising given that the buy/sell agreement was put in place in 2001 and the owner passed in 2013. Their problem would have been far worse if the policy were for significantly less than the deceased owner’s share of the business. The estate tax implications likely would not have changed, but their ability to execute the sale would have been severely compromised. This is where the danger of “outgrowing your business insurance” comes into play.

These business owners are undoubtedly not unique in their lack of periodic review of their buy/sell agreement, the value of the business and any related insurance policies. To make matters worse, there are both insurance solutions and valuation services available that can make that process as painless as possible. All it takes is using an insurance provider that offers products built for this specific purpose, not only insuring the value of the business today, but having a built-in mechanism for both periodic review and commensurate increases in coverage as the business grows.

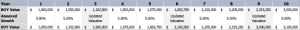

The first step is to set the value of the business with a formal valuation. This is followed by implementing the funding with life insurance. In each subsequent year, the business owners execute the increase option, including a renewed formal valuation every third year. See Table 1, below, for a description of how this could play out.

The insurance company offering this product will do the valuation at no cost. The end result is a product and process that prevents the fact pattern of the Connelly case from occurring while ensuring the adequate funding of the buy/sell agreement. In short, preventing the business from outgrowing their insurance.