Two factors, one already in place, the other on the horizon, will combine to erode assets left to IRA beneficiaries at an unprecedented rate. This “one-two punch” can be avoided with a straightforward planning approach designed to minimize the tax by shielding IRA assets from taxation.

Most are well aware of the massive amount of wealth held in retirement accounts. What may not be as well known outside the financial planning community is how significantly those assets will be eroded as they pass to the next generation. Simply considering the income tax implications points to the SECURE Act of 2019 as an accelerant of sorts. Most IRA beneficiaries no longer have the ability to “stretch” the distribution of the inherited IRA over their lifetime. Instead, the IRA has to be distributed over a ten-year period.

The second element of this planning challenge is on the horizon: The sunset of the Tax Cuts and Jobs Act (TCJA) at the end of 2025. While much of the discussion of the sunset focuses on changes to estate tax laws, for IRA beneficiaries the changes to income tax rates may be more important. Why? Just as they are being forced to take large, taxable distributions form their inherited IRA, the rate at which those distributions are taxed is due to increase when the TCJA sunsets.

This has major implications for both those who are in the ten-year distribution phase as well as those anticipating inheriting an IRA.

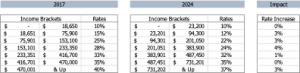

For those already in the process of distributing an inherited IRA, a quick look at the potential increase in income tax rates based on the TCJA sunset as shown in Table 1 indicates an increase of anywhere from 0% to 4% in marginal tax rates for taxpayers filing jointly as rates revert to 2017 levels. Depending on the rest of the client’s income tax planning, it may make sense to accelerate distributions of the IRA prior to the TCJA sunset to avoid these higher rates.

Those anticipating an IRA inheritance, further accelerating those distributions likely doesn’t help, as it would have to be on such a short timeline that the increased would undoubtedly result in the client jumping up to a higher income tax bracket. For these clients, the panning work has to happen before the inheritance is received.

In this case, the fact that approximately 36% of retirees who withdrew funds from a traditional IRA in 2021 used the money to reinvest or save. The likely cause of these distributions is undoubtedly Required Minimum Distributions that force the IRA owner to liquidate a portion of their IRA each year once they reach a certain age. The question for this discussion is what are these clients doing with the money? Where are they investing it? From the perspective of the beneficiary anticipating receiving the IRA as an inheritance or the IRA owner concerned about so much of their hard-earned money being lost to taxes, a life insurance policy may be the best vehicle for a few simple reasons:

- Each premium dollar is immediately leveraged, increasing the amount that passes to the next generation.

- Life insurance proceeds pass income tax free and there are no rules around distributions once received

- Life insurance proceeds can also pass estate tax free with proper planning

In short, transforming the tax in efficient IRA into a tax efficient life insurance strategy can avoid the tax double whammy created by the SECURE Act and TCJA sunset by reducing the amount subject to taxation. This tried-and-true planning strategy is more relevant than ever given both current law and the apparent inability of Congress to pass meaningful legislation over the recent past.

1 https://www.wsj.com/articles/retirement-required-minimum-distributions-tips-11668797319 What to Know About RMDs and Retirement Planning, Nov. 27, 2022.