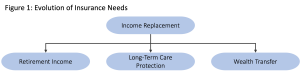

As clients age, they can find themselves in an enviable position: Their insurance assets have done what they were designed to do: Provide protection for their loved ones. In the process, they often amass significant policy cash value. As the client’s needs change, however, this insurance asset may not be flexible enough to meet their current needs. In most cases, client’s needs evolve from simple income replacement to a more diverse set of objectives as shown in Figure 1, below.

The Challenge

On the surface it seems rather simple: Reposition the cash value from the current insurance into new solutions that more closely match the client’s updated planning objectives. The reality is that there is no singular product that can accomplish all these objectives, and “splitting” the cash among multiple solutions typically involves a full surrender of the existing policy, triggering what can often be a rather sizable taxable event.

The Solution

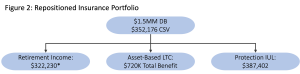

Fortunately, there are a handful of insurance companies that offer “all seasons” product portfolios and the ability to “split” incoming 1035 exchanges upon receipt. This ability allows them to allocate funds to three separate solutions that can effectively transform the client’s insurance assets into a portfolio that matches their current needs far better than a single policy solution. In this instance, a 57-year-old male with a $1.5MM policy with $352,176 of surrender value was repositioned as shown in Figure 2, below.

The total death benefit coverage inclusive of both the Protection IUL and Asset-Based LTC policy should the client not need care during their lifetime is $627,402 with no additional premium outlay. The annuity provides guaranteed income of over $322,000 over the client’s lifetime. If the client needs care and exhausts the LTC benefits, “total coverage” including income is $1,429,632.

The contents of this document should not be considered as tax or legal advice. Any information or guidance provided is solely for educational or informational purposes and should not be relied upon as a substitute for professional advice. It is always recommended to consult with a licensed financial or legal advisor for specific guidance related to your individual situation.

* Income begins at age 66, $10,741/yr guaranteed for 30 years