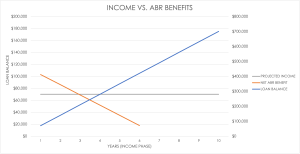

A more thoughtful approach regarding when to take income from downside-protected Life insurance assets can make a massive difference in retirement outcomes for clients. In this case, it prevents the depletion of the client’s assets prior to their death, turning a zero balance into a healthy, $1.5MM portfolio.

History is full of periods of market volatility. Most recently, the extended bull market ended in spectacular fashion in 2019, ushering in a period of volatility that continues to make clients nervous. For those still working to accumulate wealth, it can be argued that this period represents an interesting buying opportunity. Taking advantage of that opportunity can expose clients to swings in both directions, causing some to think twice before committing assets. For others, including those closer to or in retirement, volatility is a threat to a successful retirement.

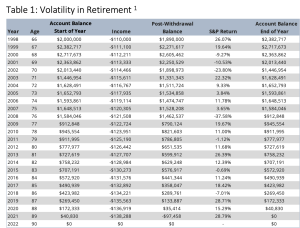

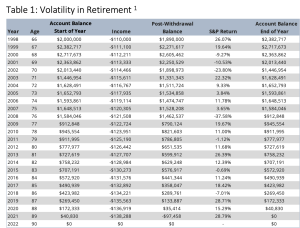

Volatility at the wrong time can turn what appears to be an adequate rate of return into a portfolio that could be exhausted before the client’s death. This suggests an obvious question: What’s the alternative? Exiting the market in an attempt to avoid market losses is not a viable solution, as market returns remain critical to a successful retirement over the long term. Asset allocation strategies can only do so much, leaving financial instruments with some level of downside protection as a critical element of addressing the risk of excess volatility and sequence of returns. Table 1, Volatility in Retirement, shows what volatility can do to a retirement portfolio in very clear terms.

Table 1: Volatility in Retirement¹

Individuals using life insurance products as part of their retirement planning strategy, however, may have an elegant solution at their disposal regardless of where they find themselves in their retirement planning journey. Clients still accumulating assets can use their life insurance position to either stay in or enter the market with the comfort of some level of downside protection. For those in retirement, a properly designed and funded life insurance strategy can both avoid negative volatility and participate in positive volatility, resulting in a very different retirement outlook.

Over the recent past, the insurance product of choice for this approach was often Indexed Universal Life (IUL), offering a 0% floor and some level of upside, limited by either a cap, spread, or participation rate. While those products remain an option, they are not the only option available from the insurance segment. Today’s insurance market offers not one, but three unique products that absorb or avoid some level of a market downturn while also offering some sort of positive return. They each have their own unique “value proposition” that may ultimately make one more suitable than the others for a specific client’s risk tolerance and other elements of their retirement planning.

- Whole Life: Guaranteed positive return each year. Modest additional upside

- Indexed Universal Life: Complete protection against market risk. Market-linked upside subject to a cap, spread or participation rate. Account values are subject to “losses” based on policy charges in years that hit the floor

- Buffered Strategies in Variable Life: Protection for some level of market risk before client account values are impacted. Market-linked upside subject to a cap. Caps in this segment are typically higher than those in the Indexed UL segment. Like the IUL segment, account values in this category may be reduced by policy charges in years that trigger the buffer.

Clearly, clients can position some of their assets in vehicles that can avoid some or all negative volatility. There is, however, a cost to that downside protection in the form of limits on the upside potential they offer.

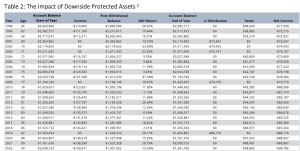

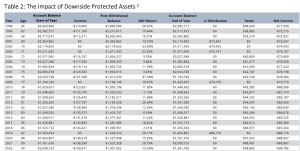

What’s less clear is the impact any of the three approaches may have on retirement portfolios broadly, as well as how to think about using these products when in retirement. Table 2, The Impact of Downside Protected Assets addresses the first question of the impact on retirement portfolios.

Table 2: The Impact of Downside Protected Assets²

Table 2 shows the superior outcome for the client. By taking an equivalent, non-taxable distribution from a life insurance contract in the years following a down market, the client not only enjoys the same level of purchasing power, but also has a portfolio value that remains in excess of $1.5MM through age 90. The importance of this can’t be overstated in an era of elevated inflation and the spiraling cost of care later in life. That said, two elements of the strategy remain an open question: How to fund the life insurance strategy and which product type is the most suitable? Before those questions can be addressed, it is critical to understand how much additional capital would be required in the traditional investment portfolio to achieve a similar outcome? In the example used here, the client would need a starting account balance of $2,475,000 to support the desired income stream and a projected ending account balance at age 90 of $1,560,000.

With that additional capital requirement in mind, it is then possible to project how much capital the three insurance strategy alternatives, Whole Life, Indexed UL and a Buffered VUL might require to achieve the outcome shown in Table 2. ³

- Whole Life: $200,000

- Indexed UL: $170,000

- Buffered VUL: $130,000

From a client outcome perspective, all three of the insurance solutions deliver a positive outcome:

- The client’s income goal is met, including a small increase each year to offset some level of inflation

- The client’s assets are preserved, with a projected portfolio value over $1.56MM higher than the original plan

- Based on the lower capital requirements of the insurance strategy (As little as $130,000 versus $475,000), the client may also enjoy more net spendable income throughout the accumulation phase when compared to simply accumulating more assets in a traditional investment account.

There remains, however, one additional topic to consider and that is which of the three possible insurance solutions is the right one to use? As tempting as it is to try to identify an empirically superior solution, the reality is that the best product will vary depending on the client, their risk tolerance, and the rest of their portfolio. While three product solutions are mentioned specifically here, there are some additional nuances to consider based on the age of the client at policy inception.

First, for the younger client, a VUL that offers indexed or buffered strategies may, in fact, be the most appropriate. Given that this strategy does take some time to “season” clients in their 40’s are ideal prospects and would have enough time on their side to consider using traditional subaccounts at policy inception, with a subsequent transition to indexed or buffered strategies as they near retirement. For clients who may be a bit older, full exposure to downside risk may not be appropriate, making one of the downside protected strategies most suitable. Clients getting a later start may need to let the insurance policy “season” a bit longer or allocate more capital to the strategy.

Regardless of how those nuances play out, the end result is yet another powerful argument for the increased use of insurance products in the retirement planning process based on their unique risk/reward profile and favorable tax treatment.