The answer, of course, is no. That said, this is exactly what some clients may think is possible with the “Swiss Army Knife” approach to Indexed Universal Life case design. The typical illustration, regardless of the illustrative rate used, displays the maximum level income possible. One of the underlying assumptions in that illustration is nearly always the use of participating loans. While there is nothing inherently wrong with that approach, it does become a problem when the policy’s living benefit features are an important part of the sale.

When considering these products, most clients will undoubtedly be attracted to the value proposition of a single product that offers death benefit protection, supplemental retirement income and a backstop of benefits should they need care later in life. What they don’t understand, unless the advisor takes the time to fully explain policy mechanics, is all of these benefits effectively come from the same pool of money. Their expectation is that they have all three of these benefits and that they are independent from one another. The living benefits, in their mind, are in addition to any income they may take from the policy. The reality is that the use of loans to take income out of the policy effectively eliminates the client’s ability to access the living benefits like a Chronic Illness or Long-Term Care Accelerated Benefit Rider (ABR).

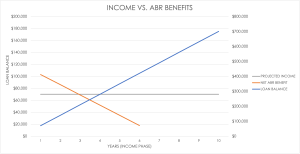

The primary reason behind this is in the fine print of these riders. Virtually all of them include a provision that requires a partial repayment of any outstanding loans with each benefit payment under the ABR. Even with a modest loan balance, the end result is a net payment to the client, reduced by the loan repayment, that is less than the income they are already taking from the policy. In addition, most ABRs have a provision that forbids taking loans and benefits under the ABR in the same year. Clients have to take one or the other. Figure 1, below, demonstrates how quickly an outstanding loan balance becomes an issue: The net benefit from the ABR can fall below that of the income they are already taking as quickly as the 4th year of the income phase. This essentially eliminates any increased income from the ABR, exactly the opposite of their expectation.

Fortunately, there is a solution. It requires changing the way income is illustrated and ultimately taken from the policy. Rather than illustrate income via loans from day 1, illustrate income via withdrawals to basis before any loans are taken. This immediately defers the onset of one of the factors driving this issue: The accumulation of a loan balance that has to be repaid when on claim. This is but one of a handful of case design and management best practices to follow as well:

- Illustrate income via withdrawals. This defers the accumulation of a loan balance and produces a lower illustrated income.

- Begin income later in life. This again pushes out the time when a loan balance will begin to accumulate, preserving meaningful ABR benefits.

- If and when the clients needs care, resist the temptation to immediately file a claim. Given that most claims last for less than five years, simply beginning to take a larger income projected for five years via loans may produce a larger net payment to the client than available ABR benefits. This also avoids the paperwork and potential delays in accessing funds that can stem from even the most efficient claims process.

As effective as those strategies may be, they do not truly address the underlying issue of all policy benefits coming from the pool of money. For the client who truly wants all three of these benefits, a multi-policy solution that addresses all three needs is undoubtedly going to be a superior solution. It will, however, require a greater financial commitment, which some clients may not be able or willing to make. If that’s the case, then a properly structured and managed single product strategy is a great start to managing these planning risks.