With the cost of capital increasing dramatically as interest rates have risen, many commercial loans now have terms that are far less favorable, if not punitive. Fortunately, clients with life insurance assets have access to a “refinancing” strategy that can provide relief from higher rates in the near term and a long-term management plan.

With the current higher interest rate environment appearing to be more than a short-term phenomenon, clients with significant commercial loans are seeking relief from the interest burden they now bear. While shopping for a more favorable rate can certainly help, the reality is that today’s rates are so much higher than when many existing loans were originated, a slightly lower rate provides remains far in excess of the original loan terms.

Paying down these loan balances would certainly provide the interest rate relief clients are seeking, but these loans are often used to fund business expansion or other planning objectives that remain important to the client. Attempting to unwind a strategy designed to capitalize on a business opportunity to pay back a loan will often simply trade one pain for another: The pain of higher rates for the pain of missing out on the business opportunity they were pursuing. Some clients, however, may already own an asset that is perfectly suited to “refinancing” these loans at terms that are far more favorable than even the most well-qualified client can find in the market.

The asset? Cash value life insurance. In fact, this very same life insurance policy may have been the actual collateral used to secure the commercial loan in the first place. The available interest rates were far lower than those available on loans from some insurance policies. As rates have risen, however, the best use of the policy cash value may no longer be as collateral. It may be paying off the bank loan. There are two variables that have to be considered when considering the loan repayment:

Is the loan interest rate in the life policy more favorable than the bank loan? Even as bank loan rates have risen, they may remain lower than the rate available on the policy loan. The net cost of the policy loan, however, is likely to be lower based on the policy also receiving some sort of credit on the loan balance.

What’s the long-term performance impact of the policy loan? Larger loan balances can seriously impair the future performance of the policy.

For some, the answers to these questions will be favorable and a loan from the policy is a clearly superior option when compared to the terms now available from the bank. Unfortunately, that will not always be the case. Whole Life policies in particular frequently have much higher loan interest rates and large loan balances create a drag on policy performance that results in a risk of lapse in the future.

There is, fortunately, a potential remedy to the scenario described above. That remedy involves sourcing a new life insurance policy, funded by a 1035 exchange, that offers the low loan interest rate we are seeking and a strategy for maintaining long-term policy performance. In some instances, the client can extinguish the loan balance without having to pay out of pocket, leaving them out from under the bank loan they are currently struggling with and with an adequately funded policy.

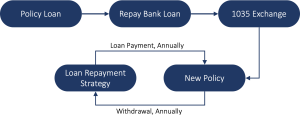

To execute this strategy, there is a proper order of operations, so to speak, that needs to be followed if the life policy was, in fact, used as collateral for the bank loan. Trying to execute a 1035 exchange with the existing policy encumbered by a collateral assignment will typically not work. Instead, the following steps need to be followed:

- Take a loan from the existing policy first. That loan is used to bay off the bank loan, allowing the bank to release their interest in the policy.

- Once that is complete, a 1035 exchange to the new policy with more favorable terms can be completed.

- With the new policy in force, the repayment strategy begins, using annual withdrawals up to cost basis to make loan payments until either the cost basis is exhausted, or the loan is extinguished.

See Figure 1: The Bank Loan Refinancing Strategy for additional details on how this strategy plays out.

As mentioned previously, in a perfect world this loan is completely paid off without the client having to make any out-of-pocket payments. Extremely high loan-to-value ratios or a lower cost basis may not allow for a complete repayment. In those instances, the client can pay off the balance of the loan from other assets. That said, they may not have to. By minimizing the loan balance, existing policy values and projected crediting may be enough to support the policy long-term. In either case, the client’s primary objective is met: They are no longer subject to today’s higher rates on their outstanding bank loan.