Choosing the right life insurance can be overwhelming, but it doesn’t have to be. Edison Risk is here to break down the essentials and help you understand the different types of policies available. From term life to whole life, understanding how each works is key to ensuring you’re well-covered. To dive deeper into various life insurance strategies, we encourage you to visit our partner, The Policy Shop, for expert insights and detailed information. Their resources will guide you through the decision-making process, so you can secure the protection you need for you and your loved ones.

How IULs Maximize Wealth – Discover the wealth-building potential of Indexed Universal Life Insurance. Link

Navigating Life Insurance with Confidence – Confidently navigate life insurance decisions with expert guidance. Link

Life Insurance and Taxes: Unlocking the Tax Benefits – Explore tax-saving benefits of life insurance for your financial plan. Link

What Is a 529 Plan? Everything You Need to Know – Learn about 529 plans and how they compare to other college savings strategies. Link

Term & Whole Life Insurance – Understand the differences between term and whole life insurance policies. Link

529 vs IUL: College Planning Comparison – Compare 529 plans with Indexed Universal Life for better college funding. Link

Unlocking Financial Security with IULs – How Indexed Universal Life Insurance can safeguard your financial future. Link

RetirementPAYDAY Annuity: Safeguarding Your Future – Protect your retirement income with RetirementPAYDAY annuities. Link

Top 11 Must-Read Blog Posts for Life Insurance – A curated list of must-read life insurance blogs for better financial understanding. Link

RetirementPAYDAY Annuity – Explore how RetirementPAYDAY annuities secure your retirement income. Link

Exploring Riders and Add-Ons for Life Insurance – Learn about life insurance riders and how they customize your policy. Link

The Policy Shop – Explore a wide range of life insurance solutions at The Policy Shop. Link

Protect Your Retirement Income with RetirementPAYDAY Annuities – Safeguard your retirement income with our RetirementPAYDAY annuities. Link

Unlocking Liquidity: Financial Flexibility with Life Insurance – Learn how life insurance can provide liquidity and financial flexibility. Link

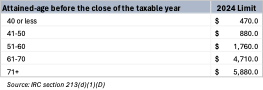

Life Insurance Strategies Under TEFRA, DEFRA, and TAMRA – Discover life insurance strategies under these key regulations. Link

Understanding TEFRA, DEFRA, and TAMRA – Learn how these laws affect life insurance strategies and tax planning. Link

IUL vs Roth IRA: Which is Best for You? – Compare Indexed Universal Life Insurance and Roth IRAs for financial growth. Link

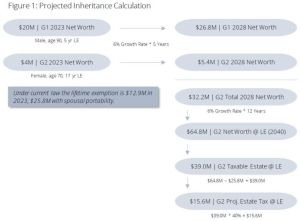

Advanced Estate Planning with Life Insurance – Use life insurance to minimize tax liability in advanced estate planning. Link

RetirementPAYDAY Annuities in Retirement Planning – Learn how RetirementPAYDAY annuities fit into your retirement planning. Link

TEFRA, DEFRA, and TAMRA Explained – Understand the impact of TEFRA, DEFRA, and TAMRA on life insurance. Link

Planning for Your Child’s Future: College Funding with CollegePLUS IUL – Explore CollegePLUS IUL as an alternative to 529 plans for funding education. Link

401K to Annuity Conversion: RetirementPAYDAY – Learn how converting a 401K to an annuity can help with long-term healthcare costs. Link

Navigating the TEFRA Test in Life Insurance – Explore the TEFRA test and its implications for life insurance policies. Link

Maximize Retirement Savings with RetirementPAYDAY Annuities – Secure your retirement by maximizing savings with RetirementPAYDAY annuities. Link

Shop at The Policy Shop – Shop a variety of insurance options that suit your financial goals at The Policy Shop. Link