Varying economic conditions cause permanent life insurance products to fall in and out of favor. That’s not much of a problem for new insurance policies, but for in force policies it presents a major issue: Actual performance that does not meet expectations set at the time of sale. When that happens, a policy owner may not have great choices as they see to make the best of a bad situation. Unless, of course, their policy was purchased with just this possibility in mind.

Dealing with actual performance that does not meet the sales illustration or client expectations is all too familiar to those who have sold many types of life insurance. Declining dividend rates in Whole Life (WL). Market performance that didn’t materialize in Variable Universal Life (VUL). Index Cap and Participation rates that were unsustainable in Indexed UL (IUL). That doesn’t make any of these products inherently inferior or inappropriate. It does, however, point out that they can lack the flexibility needed to manage varying economic conditions. The exception? It may be Variable Life, but with a twist.

The rise of downside protected insurance products that also offer market-based returns has resonated with many consumers for easily understandable reasons. Primary among them is loss aversion. Once that is in place, however, the other side of the coin in the form of performance enters the conversation. In the case of IUL, actual performance can be severely limited by both the Cap and Participation rates, particularly as a segment matures and is subject to a renewal Cap or Participation rate. This is where performance can start to lag, and policy owners start to look for alternatives. Typically, that means either stay the course, or pivot to a new vehicle. Even if they are insurable and outside the surrender period, they are likely to be hesitant to commit to a similar strategy with a new product that is more well suited to the current economic environment.

A more graceful solution would avoid the need for underwriting and surrender charge considerations if it were already present in the very policy the client already owns.

Fortunately, that product exists. Numerous offerings in the VUL segment include “indexed subaccounts” based on the very downside protected indexing strategies found in IUL. In addition, buffered strategies that have become widely available in the Variable Annuity market have now made their way into the VUL market, offering a different balance of downside protection and upside potential than an IUL or indexed subaccount. Clients who own a VUL with these strategies are in an enviable position: Their solution to falling Cap rates, as an example, is built into the product they own.

If Cap rates, as an example, fall to the point that the upside potential of the strategy is no longer acceptable to the policy owner, they can simply change their allocation to a more suitable or attractive alternative from the menu of subaccounts available in their product. While it is tempting to think about this only in the context of wanting more upside potential, it could very well be predictability that the client is seeking in some instances. In that case, perhaps an allocation to the fixed account makes the most sense. Perhaps a bond fund allocation? Further, this is not an “all or nothing” decision and allocating a portion of their cash values across multiple subaccounts, each with its own unique risk/reward profile, may be the most appropriate course of action.

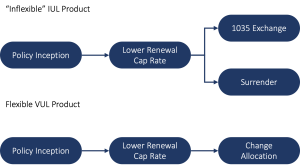

See Figure 1, below, for additional details on the difference between an IUL and VUL in these circumstances.

Figure 1: Strategies for a Falling Cap Rate

The point? There is never an empirically superior product type. The one that happens to be in favor today may very well be out of favor or perhaps significantly impacted by changing economic conditions within a few years. Rather than try to “time” the insurance market, perhaps it’s time to simply use a more flexible strategy that gives the clients a way to pivot when conditions change?