The Role of Life Insurance in an Asset Location Strategy

Asset Allocation has been part of the investment professional’s asset management strategy for decades. More recently, a considerable amount of attention has been focused on a natural extension of that approach: Asset Location.

While the two terms are extremely similar, their meaning is quite different:

- Asset Allocation: The selection of a diversified portfolio of stocks, bonds, cash and alternatives aligned with an investor’s time horizon and risk tolerance.

Asset Location: The placement of assets in taxable, tax-deferred and tax-free accounts with the goal of minimizing taxes

Where is Asset Location Being Talked About?

A quick Google search uncovers any number of hits from asset managers and the like, but if we look at where most consumers may ultimately go for information on a topic like this once they are exposed to it, two sources stand out:

Investopedia: Minimize Taxes With Asset Location

Fidelity: Are you invested in the right kind of accounts? See how tax-smart asset location can potentially help improve after-tax returns.

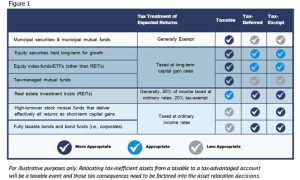

Fidelity goes so far as to outline the tax treatment of various assets as part of their effort to educate their clients as seen in Figure 1.

Asset Location – Figure 1

You will likely notice one very important omission in both of those articles and Figure 1: Both Fidelity and Investopedia have neglected an asset class that should play a large role in the Asset Location conversation: Cash Value Life Insurance. This omission is not just common, it’s nearly universal. The asset management community largely has no idea how life insurance fits in this approach they have already embraced and are using with their clients.

We’ve known for years that life insurance’s unique value proposition positions it as an analog to things like Roth IRAs that have the following characteristics regarding taxation:

Tax-free: Will be invested after tax, but you will not pay taxes on any distributions from these assets.

Of course, life insurance has a significant advantage: The income-based limitations that can prevent clients from utilizing Roth IRAs don’t exist for life insurance.

If we investigate the account types that fall into the tax-free category further, as seen in Figure 2, the advantages of life insurance over alternatives becomes even more clear:

Asset Location – Figure 2

What’s the Bottom Line?

In short, positioning cash value life insurance as a tax-free asset in an asset location strategy is an ideal way to introduce clients to the unique tax treatment of life insurance. It solves a challenge they face in terms of income-based limitations and the like that can prevent them from utilizing more traditional tax-free assets that offer market returns.