It’s tempting to use an “apples to apples” approach when considering the premium deposit used to fund an Asset-Based LTC solution. Given the availability of a tax-free 1035 exchange when an annuity is the source of funds, it’s critical to take any tax taxes due on the surrender of the annuity into account when determining the amount available to fund the strategy.

We all know how important it is to keep things simple for clients. Covering the essential components of a planning strategy as efficiently as possible increases understanding and improves the quality of their decisions.

In the Asset-based Long-Term Care (ABLTC) segment, however, there is a detail that must be considered that is often overlooked: Source of funds. Specifically, clients need to understand the pros and cons of using non-qualified funds versus qualified funds, annuities versus brokerage accounts and the like when funding their care planning strategy.

This becomes even more important when we consider the tax ramifications specific to each funding source, particularly when considering non-qualified annuities. Why call out non-qualified annuities specifically? Simple: There’s an opportunity to avoid a taxable event altogether by selling an annuity-based ABLTC product. The availability of a tax-free 1035 exchange into an annuity-based ABLTC product unlocks the power of the Pension Protection Act and changes the true cost of the care planning strategy.

These cases can play out in a couple different ways. The most common is a “Money Purchase” approach that starts with the existing annuity’s cash value. That amount is used as the single premium to purchase an ABLTC solution. The tax issue is often overlooked and has a material impact on the decision-making process. More specifically, the single premium used to fund a life-based ABLTC product should be discounted by the taxes due on the liquidation of the annuity. That net amount is then used as the single premium on a life-based solution, while the full amount can be used to fund an annuity-based product. Please see Table 1 for an example.

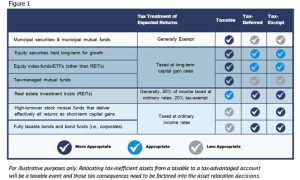

Table 1: Impact of Taxes on Non-Qualified Annuities

¹ Tax Rate Assumptions: 24% Federal, 10% State, for a combined 34%

Table 1 shows the significant difference in the net premium available to fund a care planning strategy with funds from a non-qualified annuity based on the type of ABLTC product being considered. While the full amount is available to an annuity-based product. the lower amount net of taxes is what is truly available to fund a life-based care planning strategy.

The resulting impact of an increased premium on available LTC benefits is obvious: With more funds deposited into the annuity product, the corresponding benefits may be richer. Does this mean that an annuity-based product is always going to outperform a life-based product? Absolutely not. It will increase the frequency of the annuity-based solution delivering superior benefits, however.

The fundamental question that needs to be answered is if the increased funding into the annuity-based solution is offset by the superior leverage typically found in life-based products? In this case, with a 35% combined tax rate assumption, the life-based product would have to deliver a 20.48% greater monthly benefit per dollar of premium for the total monthly benefit to equal the benefits available from an annuity-based solution This is demonstrated by the following calculation:

- Life-Based Premium: $166,000

- Annuity-Based Premium: $200,000

- Shortfall: $34,000

- Shortfall as % of Life-Based Premium: $34,000/$166,000 = 20.48%

Consider a sample case, with the following case design parameters:

Male, age 70

- Couples Discount

- 6-year Benefit Period

- 3% COLA

- Maximum Monthly Benefit

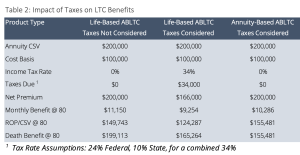

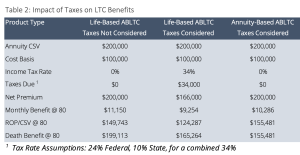

Revisiting the cash flows from Table 1, above, now including the corresponding monthly benefit amounts, shows not only the superior outcome of the annuity-based solution for this case, but also how it could have been “hidden” if the reduced, after-tax deposit amount was not used. Please see Table 2 for additional details:

Table 2: Impact of Taxes on LTC Benefits

¹ Tax Rate Assumptions: 24% Federal, 10% State, for a combined 34%

Table 2 shows how case design is impacted by the source of funds. Not taking the taxes due on the surrender of the annuity into account could easily lead to a sub-optimal recommendation. At first glance, it appears that the life-base solution is superior. However, that design has a hidden cost of an additional more than $34,000 in taxes as seen in the column titled Life-Based ABLTC, Taxes Considered.

This effectively reduces the amount available to fund the life-based strategy. A review of the additional two columns showing the impact of taxation point to the annuity as the superior solution in terms of monthly benefit. In this case, a monthly benefit at age 80 that is $1,032 or 11.15% higher in an annuity-based solution.

Other Considerations

While the primary metric in a care planning case is usually the monthly benefit amount, there are other factors at play. The death benefit that may pass to beneficiaries if not accelerated for care is likely the most significant. Not only are death benefits from the life-based products typically larger, but they are also tax-free to the beneficiaries. Liquidity is typically superior in an annuity-based versus life-based product. These factors will need to be considered as part of the decision-making process.

Another important point to consider is the use of a COLA Rider. Annuity-based products like the one used in this example may perform better without a COLA Rider. The current crediting rate of the annuity, if used to project future benefits, can result in a greater monthly benefit. That amount, of course, is not guaranteed, while the benefits available from the COLA Rider are contractually guaranteed. Given the nature of the sale, the guaranteed benefits are likely more appropriate as well as being directly comparable to those from a life-based solution.

All of the above as well as the ultimate outcome is dependent not only on the use of the appropriate premium amounts, but also the age of the client, use of a COLA Rider and the like. None of that however changes the bottom line need to use the annuity value net of applicable taxes when running proposals.

A potential complication is the annuity with a surrender value in excess of the premium needed to fund the strategy. Fortunately, most annuity carriers, including those that offer annuity-based ABLTC products, also offer other annuity products and may be able to execute a “split 1035 exchange” upon receipt of the funds. This would allow a portion of the exchanged funds to be allocated to the annuity-based ABLTC product with the balance being deposited into a different annuity product from the same carrier. While more complicated, the surrendering company may be able to facilitate a split exchange involving two different receiving companies, creating additional flexibility for clients in this situation.

Underwriting comes into play as well. Annuity-based ABLTC products may offer a simplified underwriting process that is also more accommodating of some health conditions.

Next Steps

Fortunately, taking the impact of taxes into account in these scenarios involves only two additional pieces of data and a bit of math: When working with non-qualified annuities, always calculate the net premium amount using the cost basis and an income tax rate assumption when not utilizing a 1035 Exchange. Use the resulting net proceeds available to fund a life-based product and run proposals for both life-based and annuity-based products accordingly. The results may surprise you!