If you’ve worked in the business market, you are undoubtedly familiar with Section 162 Bonus Plans. Rather than the traditional life insurance focused approach, this fresh approach delivers something that may be perceived as even more valuable: Long-Term Care coverage.

Life insurance has long been used as an Executive Benefit, with myriad strategies for structuring agreements that can further corporate objectives around employee recruitment and retention. Despite the high usage rate of life insurance products, this use case has not carried over into the Asset-Based Long-Term Care (ABLTC) product segment. Given the forces in play that shine a light on the need for more effective care planning strategies and funding solutions, the benefits offered by an ABLTC solution may be more valuable than life insurance in the eyes of key employees.

The combination of personal experience with their loved ones needing care, the increasing cost of care and the rising tide of state level legislation focused on Long-Term Care has created an environment where employee and employer alike can benefit from implementing a plan. These benefits may also expand to include reduction of taxation of both the business and employee relative to Long-Term Care legislation, making the coming years particularly interesting for Executive Benefit offerings in this product segment.

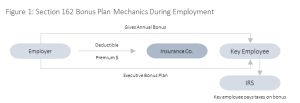

Given their relative simplicity and utility across multiple business entity types, Section 162 Bonus Plans stand out as an attractive structure for businesses evaluating implementing an ABTLC plan for their key employees. Please see Figure 1: Section 162 Bonus Plan Mechanics During Employment for additional details on these arrangements.

Figure 1: Section 162 Bonus Plan Mechanics During Employment

In the example outlined in Figure 1, the employer gives its employee an annual bonus amount equivalent to the annual cost of the policy premium. The employee owns the policy and will need to pay income taxes on the bonus, just as they would for any compensation received from their employer. The employer may also choose to compensate the employee with a bonus that covers the annual premium plus the income taxes due by the employee. This is commonly referred to as a double bonus. To incentivize longevity with the company, the employer may choose to spread premium-payment bonuses over five, 10, or more years, as well as restrict access to the policy in other ways that incent the employee to remain with the company. If the employee stays with the company for the required amount of time, they will own a fully funded policy

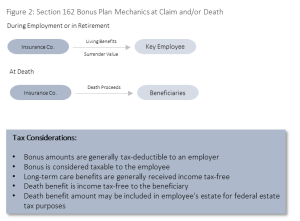

During the balance of the employee’s career, they continue to enjoy the valuable coverage, knowing that they have an important piece of a comprehensive financial plan in place. Should they need care before or in retirement, the benefits from the policy flow as outlined in the top section of Figure 2: Section 162 Bonus Plan Mechanics at Claim and/or Death. Given that the employee owns the coverage personally, they receive the benefits directly from the insurance company per the terms of the life insurance policy. Depending on how their particular claim ultimately plays out, there will likely be some level of remaining death benefit that would be paid to the employee’s named beneficiaries at their death, as illustrated in the bottom half of Figure 2.

Figure 2: Section 162 Bonus Plan Mechanics at Claim and/or Death

It’s important to note that this is but one approach to offering these benefits as part of a key employee’s benefits package. Businesses interested in further evaluating a plan should fully investigate alternative funding strategies that may be more advantageous for their business entity type or support other objectives they may wish to accomplish by offering a plan.

Tax Considerations:

- Bonus amounts are generally tax-deductible to an employer

- Bonus is considered taxable to the employee

- Long-term care benefits are generally received income tax-free

- Death benefit is income tax-free to the beneficiary

- Death benefit amount may be included in employee’s estate for federal estate tax purposes

Table 1, Section 162 Bonus Plan Cash Flows, shows the cash flow requirements for the business allocating $10,000 per year to an ABLTC Benefit Plan for one employee, as well as the net cost to the employee under a single bonus arrangement. As stated previously, the company could elect a double bonus structure that would increase the outlay by the company but would reduce the employee Net After-tax Cost to $0.

Table 1: Section 162 Bonus Plan Cash Flows

The Long-Term Care benefits associated with these cash flows will vary based on any number of factors, but assuming a 55-year-old male with a couple’s discount, this policy should provide a monthly benefit amount of approximately $6,000.

It’s also possible for the employee to elect to contribute some of their own assets to the policy, resulting in richer monthly benefits and/or a longer benefit period.

Possible Additional Benefits to the Business and Employee

In an era that sees an increasing number of states either implementing or evaluating state-mandated Long Term Care plans, there are additional potential benefits to both the business and the employee implementing an ABLTC Executive Benefit plan. In states like California, the taxes associated with the pending legislation include not only a payroll tax paid by the employee, but also a tax paid by the business. Given that both parties are facing some sort of possible expense related to the public long-term care option via taxation, there may be a greater appetite for allocating those dollars to a benefit offering that would be viewed positively by the employee.

While the specifics of the California legislation remain to be determined, private coverage that qualifies for an opt out of the public plan could directly address some of the major challenges this type of legislation presents to highly compensated individuals. Primary among these is the total amount paid in tax over an employee’s career. For highly compensated individuals, even a modest tax rate can translate to a massive total tax burden over their working years. Implementing a private LTC insurance plan, however, could offer two compelling advantages: Likely superior benefits and a guaranteed cost. These advantages may also be available to the business if their employee opting out of the public option also eliminates the portion of the tax paid by the business. In addition, employees will likely place much more value on a benefit from their employer that provides superior economics and benefits, reinforcing the intent of these types of Executive Benefit Plans.

The bottom line of this discussion is rather straightforward: Today’s job market is putting pressure on businesses to offer compelling benefit packages. State level Long-Term Care plans are forcing employees to purchase Long-Term Care in some fashion, by either participating in a public option or acquiring private insurance. There is a larger need for this kind of coverage with each passing year as the cost of care increases. While it is impossible at this time to determine what, if any, actual cost savings may be available to a business by implementing an ABLTC Section 162 plan, the superior relative value of the plan in the eyes of the participating employees makes offering this type of benefit rather than subjecting the business and the key employees to an unwanted and punitive tax a much more effective use of the business’s capital.