In the business market, top performers often command a more robust suite of benefits than the rest of the company. Unfortunately for some, that is not always the case. In fact, on a percentage basis, the top performers often lag the rest of the company in three fundamental areas. Fortunately, this “Benefits Gap” can be solved, either within the benefits plan itself or with individual solutions. Read on for the details!

Where’s the Gap?

The Benefits Gap shows up in three areas most frequently:

- Retirement Planning

- Disability Income Protection

- Life Insurance Protection

Even if the client “already has” these benefits in place at their employer, a quick look at the benefits relative to the client’s income surfaces a significant shortfall. Also important: If the client is relying solely on employer sponsored plans that are NOT portable, personally owned insurance is the only way to address this issue without leaving the client exposed should they change jobs.

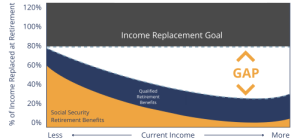

How to Close the Retirement Gap?

Closing the gap ultimately comes down to having a supplemental retirement plan. In the employee benefits setting, that can be accomplished via a deferred compensation plan or other bonus plan. Absent an employer that is willing to contribute additional funding, it’s up to the individual to make up the difference. In that case, evaluating the client’s “asset location” or the tax efficiency of their overall retirement plan, often points to the need for a larger allocation to assets that, when properly structured, are not subject to ordinary income or capital gains tax. An increase in that allocation can not only close the retirement gap, but also provide the critical tax diversification that allows clients to respond appropriately to future changes in tax rates in retirement.

Figure 1: The Retirement Gap

How to Close the Disability Gap?

It really all comes down to having a supplemental disability insurance plan that integrates with the client’s group coverage. In the employee benefits setting, that can be accomplished via an executive carve out that offers additional, personally owned and portable disability insurance protection to the executives in the organization. Absent an employer that is willing to implement a plan, it’s up to the individual to make up the difference. In that case, leveraging today’s modern application and underwriting processes can allow for implementation of significant amounts of coverage with minimum interruption of the client’s busy schedule.

Figure 2: The Disability Gap

How to Close the Life Insurance Gap?

Having a supplemental life insurance plan is ultimately how to close the gap. In the employee benefits setting, that can be accomplished via an executive carve out that offers additional, personally owned and portable life insurance protection to the executives in the organization. Absent an employer that is willing to implement a plan, it’s up to the individual to make up the difference. In that case, leveraging today’s modern application and underwriting processes can allow for implementation of significant amounts of life insurance with minimum interruption of the client’s busy schedule.